-

Jonathan Bahu🙏 63 karmaFeb 3, 2025@SyftAwesome tool! I have crafted my own tool, but Syft is the best!

Jonathan Bahu🙏 63 karmaFeb 3, 2025@SyftAwesome tool! I have crafted my own tool, but Syft is the best! -

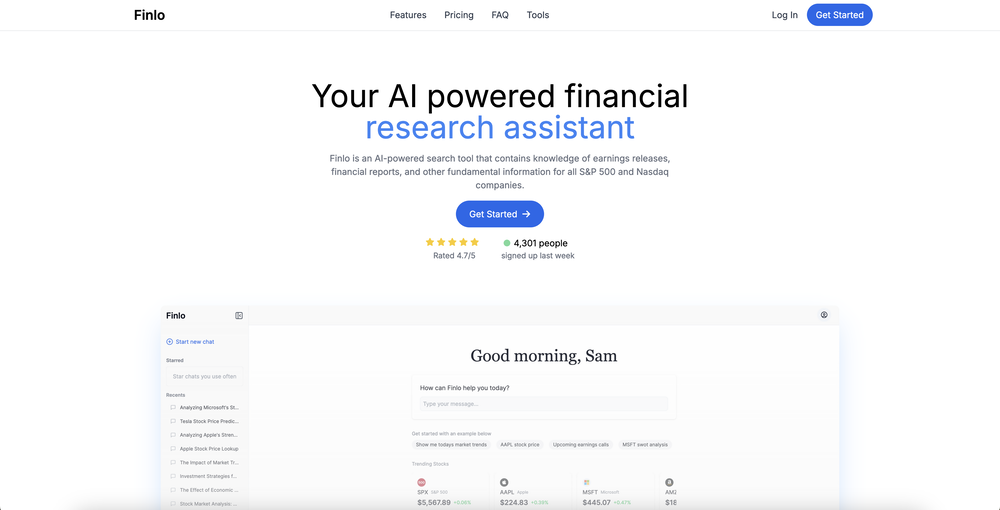

### AI-Driven Stock and Portfolio Manager **Overview:** This AI-driven stock and portfolio manager is designed to provide comprehensive financial management services, including intelligent market analysis, investment optimization, real-time monitoring, detailed financial report reading, and personalized financial advice. **Key Features:** 1. **Market Trend Analysis:** - **AI Algorithms:** Utilize advanced machine learning algorithms to analyze historical and real-time market data. - **Sentiment Analysis:** Monitor social media, news, and financial forums to gauge market sentiment. - **Predictive Modeling:** Use predictive models to forecast market movements and identify potential opportunities or risks. 2. **Investment Optimization:** - **Portfolio Rebalancing:** Automatically rebalance portfolios based on user-defined criteria and market conditions. - **Risk Assessment:** Evaluate the risk profile of each investment and suggest adjustments to align with the user's risk tolerance. - **Diversification:** Recommend diversification strategies to minimize risk and maximize returns. 3. **Financial Webinar Monitoring:** - **Real-Time Alerts:** Monitor financial webinars and provide real-time alerts on key insights and actionable information. - **Summarization:** Summarize key points from webinars to provide concise updates to the user. 4. **Detailed Financial Report Reading:** - **10-K Filings:** Automatically read and analyze 10-K filings to extract critical financial information. - **Data Extraction:** Extract key metrics such as revenue, earnings, and cash flow to assess the financial health of companies. - **Comparative Analysis:** Compare financial metrics against industry benchmarks and historical data. 5. **Personalized Financial Advice:** - **User Preferences:** Customize advice based on the user's financial goals, preferences, and risk tolerance. - **Scenario Analysis:** Provide scenario-based analysis to help users understand the potential outcomes of different investment strategies. - **Regular Updates:** Offer regular updates and recommendations to keep the portfolio aligned with the user's objectives. **User Interface:** - **Dashboard:** A user-friendly dashboard displaying real-time market data, portfolio performance, and personalized recommendations. - **Notifications:** Push notifications for important market updates, webinar insights, and portfolio adjustments. - **Settings:** Customizable settings to define investment goals, risk tolerance, and preferred asset classes. **Technology Stack:** - **Machine Learning:** TensorFlow, Scikit-learn - **Natural Language Processing:** NLTK, SpaCy - **Data Analysis:** Pandas, NumPy - **Visualization:** Matplotlib, Plotly - **Cloud Platform:** AWS, Google Cloud **Security:** - **Data Encryption:** Ensure all user data and financial information are encrypted. - **Compliance:** Adhere to financial regulations and standards (e.g., GDPR, FINRA). **Conclusion:** This AI-driven stock and portfolio manager aims to provide a comprehensive, intelligent, and personalized financial management solution. By leveraging advanced AI technologies, it ensures that users can make informed investment decisions, optimize their portfolios, and achieve their financial goals.

-

Very functional and has up to date pricing and good for technical analysis! Recent this app stop working out of nowhere smh.

Very functional and has up to date pricing and good for technical analysis! Recent this app stop working out of nowhere smh. -

Message i get when i try to access the tool from this page." Sorry, you have been blocked You are unable to access finlo.io". If they are not interested request TAAIFT to remove this if they are not interested in wider community from the platform.Very rude.. Alteast should advise to include why they block users like this.

Message i get when i try to access the tool from this page." Sorry, you have been blocked You are unable to access finlo.io". If they are not interested request TAAIFT to remove this if they are not interested in wider community from the platform.Very rude.. Alteast should advise to include why they block users like this. -

🚀 Android app is live on the Google Play Store! Enjoy full access to all features, now also on mobile.

🚀 Android app is live on the Google Play Store! Enjoy full access to all features, now also on mobile. -

This AI is awesome. You have to try it because it gives an amazing analysis on any stock. 10/10

This AI is awesome. You have to try it because it gives an amazing analysis on any stock. 10/10 -

Thank you for you for your feedback, Shin! I'm thrilled you had a unique and great experience with Capital Companion. I work hard to provide an exceptional AI-powered financial assistant, and it's gratifying to know it's making a positive impact. Please don't hesitate to reach out if you have any additional thoughts or suggestions. Thanks again for choosing Capital Companion!

Thank you for you for your feedback, Shin! I'm thrilled you had a unique and great experience with Capital Companion. I work hard to provide an exceptional AI-powered financial assistant, and it's gratifying to know it's making a positive impact. Please don't hesitate to reach out if you have any additional thoughts or suggestions. Thanks again for choosing Capital Companion! -

AI-powered financial analyst from Investing.com delivering market insights and researchOpen

Sponsor

Base44

💻 Vibe coding

#1 website for AI tools.Used by 80M+ humans.