Does Clint detect financial waste in my spending habits?

Yes, Clint can detect potential areas of financial waste in your spending habits.

Can Clint help me with financial decision-making?

Yes, Clint can help with financial decision-making. The insights generated by Clint can facilitate informed and proactive financial decision-making.

Does Clint encourage healthier spending behaviors?

Yes, Clint encourages healthier spending behaviors. By providing insights into your spending habits and detecting potential financial waste, it helps you make informed decisions to optimize your expenses.

How does Clint optimize personal finance management?

Clint optimizes personal finance management by analyzing your spending habits, uncovering potential areas of financial waste, and offering insights that can be used to make informed financial decisions.

Can I rely solely on Clint for finance management?

While Clint's AI capabilities allow for sophisticated expense tracking and analysis, you're encouraged to maintain an understanding and oversight of your financial activities yourself and not rely solely on Clint.

How does Clint automate the tracking of expenses?

Clint automates the tracking of expenses by using its AI technology to keep tabs on your expenditure, identify patterns and reveal potential areas of financial waste.

What types of insightful analysis can Clint provide?

Clint can provide insightful analysis on your spending habits, financial waste and overlooked fees in your spending habits.

Can Clint manage overlooked subscription fees?

Yes, Clint can manage overlooked subscription fees by identifying and bringing them to your notice.

Does Clint provide AI-powered insights?

Yes, Clint provides AI-powered insights. It analyzes your spending habits over time and generates insights that can help guide your financial decisions.

How does Clint facilitate proactive financial decision-making?

Clint facilitates proactive financial decision-making by providing insights into your spending habits and highlighting potential areas of financial waste.

Can Clint help me with finance optimization?

Yes, Clint can help with finance optimization. It provides insights into spending patterns and highlights areas of potential financial waste to guide informed decision-making.

Does Clint work as an automated finance manager?

Yes, Clint can serve as an automated finance manager but you shouldn't rely solely on it for your financial management.

In what ways can Clint help me with smart spending?

Clint can help with smart spending by providing insights into your spending habits, detecting and highlighting potential areas of financial waste, thereby assisting in optimizing your expenses.

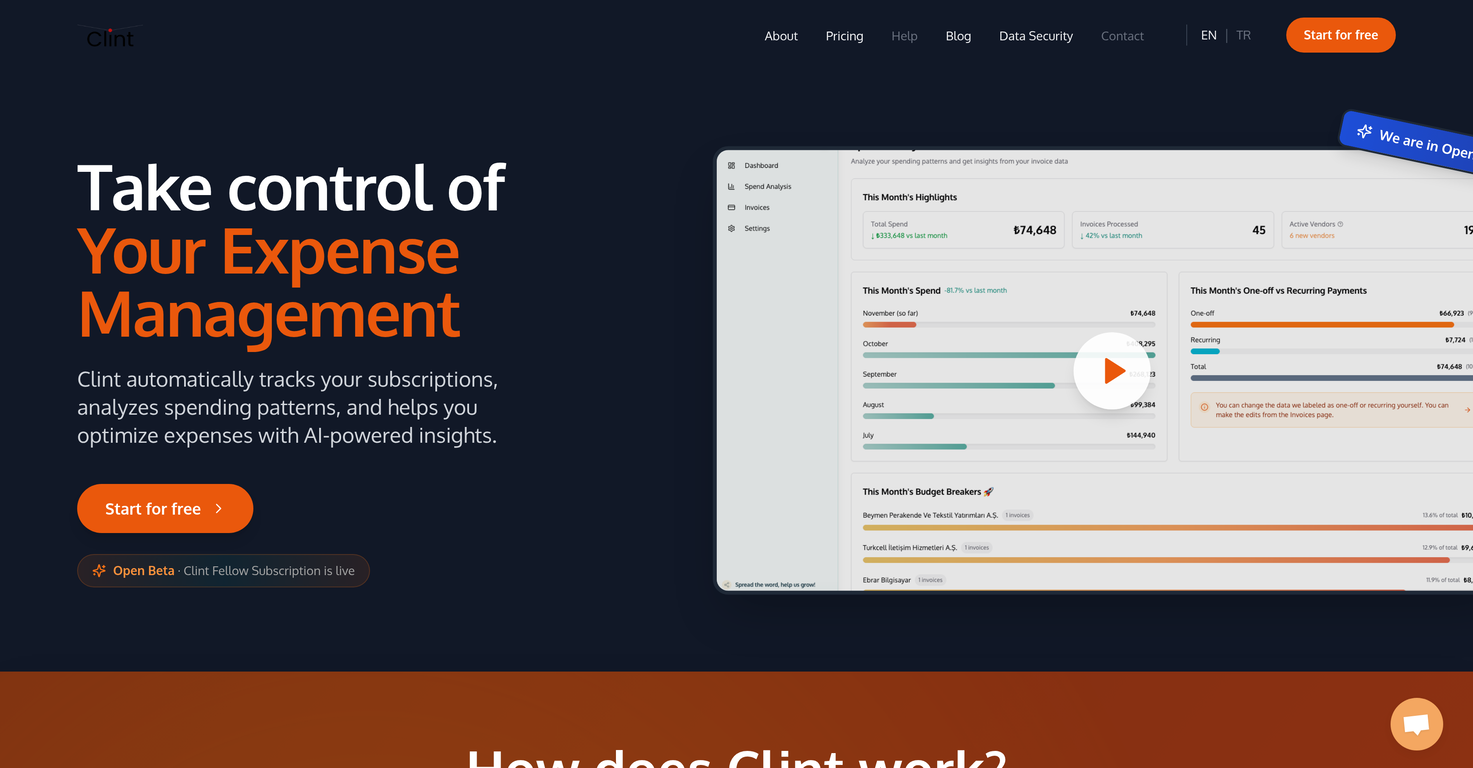

What exactly is Clint?

Clint is an AI-powered personal expense manager that assists users in tracking, analyzing, and managing their personal expenses. It leverages AI to understand and learn from the spending habits of users, thereby providing them with actionable insights and proactive financial decision-making abilities.

How does Clint's AI-powered expense manager work?

Clint utilizes cutting-edge AI technology to track and manage your expenses. It analyzes your spending patterns, identifies regular payments and subscriptions, and organizes this information in a meaningful and easily accessible way. Additionally, Clint provides comprehensive insights on your spending habits, identifying potential areas of financial waste and presenting potential savings opportunities.

What kind of expenses can Clint track?

Clint can track a wide array of expenses, with a particular focus on subscription expenses. It keeps note of all regular payments, monitors your spending habits, and identifies patterns in your expenditure.

How accurately can Clint identify my spending patterns?

Using advanced AI algorithms, Clint can accurately identify and analyze your spending patterns. This is achieved through continuous monitoring and learning from your spending activities over time, allowing the system to get insights about your recurring expenses and financial behavior.

How does Clint help uncover potential areas of financial waste?

Clint applies its AI technology to identify frequent and infrequent expenses and recognize patterns that may indicate financial waste. These could be unnoticed subscriptions or regular payments that have become unessential. By highlighting these areas, Clint helps you recognize and eliminate unnecessary expenditure thus supporting waste reduction.

Can Clint manage and track subscription expenses automatically?

Yes, Clint is designed to automatically track and manage your subscription expenses. It identifies regular payments and organizes this information in a clear, understandable way for the user's benefit.

How does Clint provide insights for proactive financial decision-making?

Clint provides insightful spending analysis, using AI to detect patterns in your expenditures. These analyses cover areas like frequency of expenses and nature of spending, which provide pivotal information for informed financial decisions. The concrete data and easy-to-understand reports that Clint delivers make proactive financial decision-making more straightforward for users.

How does Clint encourage healthier spending behaviors?

Clint encourages healthier spending behaviors by providing a detailed analysis of expenditure patterns and highlighting areas of potential waste or overlooked expenses. By shedding light on these aspects, users gain a better understanding of their spending habits, which promotes more mindful and responsible approaches towards expenditure.

Do I still need to manually track my expenses while using Clint?

While Clint provides a robust and automated expense tracking solution, users are still encouraged to maintain an understanding and oversight of their financial activities for a more comprehensive and accurate financial management.

How does Clint support personal finance optimization?

Clint supports personal finance optimization by offering detailed expenditure analysis, identifying potential financial waste and suggesting areas where savings can be enhanced. It provides actionable insights based on spending habits, encouraging users to make informed financial decisions for better budget management.

In what ways does Clint assist in budget management?

Clint assists in budget management by tracking expenses, analyzing spending patterns, and offering insights into potential saving opportunities. This allows users to clearly understand their expenditure and make necessary adjustments to their budget planning.

What patterns in my spending is Clint capable of identifying?

Clint is capable of identifying patterns in your spending including recurrent subscriptions, regular payments, and the frequency and nature of your spending. It uses this information to provide insights into your financial behaviors and suggest areas for savings or expenditure optimization.

How does Clint help in reducing financial waste?

Clint helps in reducing financial waste by identifying unnoticed or unnecessary subscriptions and payments. Through a detailed spending analysis, it pinpoints areas of financial leaks which can then be addressed by the user for better budget management.

How can Clint benefit my personal finance management?

Clint can greatly benefit your personal finance management. By providing detailed expense analyses, uncovering potential financial leaks, and offering actionable insights on your spending habits, it can assist you in optimizing your expenditures and enhancing savings.

Does Clint provide a detailed expense analysis report?

Yes, Clint generates and provides detailed expense analysis reports. These reports outline your spending habits, identify potential areas of financial waste, and suggest areas for expenditure optimization.

How do I work with Clint to manage my subscriptions?

You can work with Clint by feeding it your expense and spending data. Clint will use AI to analyze this data, track your subscriptions, and provide you with a clear overview of your expenses and spendings.

How does Clint promote financial literacy among users?

Clint promotes financial literacy among users by offering a detailed analysis of their spending habits and providing insights into potential areas of financial waste. It fosters an understanding of personal finance management and encourages making informed decisions.

Is Clint useful in enhancing savings optimization?

Yes, Clint assists in enhancing savings optimization by identifying unnecessary expenditure or unnoticed subscriptions. By bringing these to light, it allows users to address these financial leaks, thereby potentially enhancing their savings.

How detailed are the insights provided by Clint about my spending habits?

The insights provided by Clint about your spending habits are in-depth and comprehensive. They cover the frequency and nature of your spending, recurring expenses, unnoticed subscriptions, and potential areas of financial waste.

Can Clint highlight areas of unnecessary expenditure in my spending?

Yes, Clint can highlight areas of unnecessary expenditure in your spending. By scouring through your expenses, it identifies potential financial leaks or unessential expenses, assisting you in reducing financial waste and optimizing your budget.

AI-powered expense tracking through interactive chat interface.Open

AI-powered expense tracking through interactive chat interface.Open Kent🙏 25 karmaJan 27, 2025@Rolly: AI Money TrackerRolly AI offers a "cranky" AI chat and custom advisor personalities for expense tracking, delivering hilarious and savage roasts about your questionable spending choices through the app.

Kent🙏 25 karmaJan 27, 2025@Rolly: AI Money TrackerRolly AI offers a "cranky" AI chat and custom advisor personalities for expense tracking, delivering hilarious and savage roasts about your questionable spending choices through the app. MongoDB - Build AI That Scales

MongoDB - Build AI That Scales