How does Oscilar assist with fraud, credit, and compliance risks?

Oscilar helps to manage fraud, credit, and compliance risks by automating the risk decision-making process. It leverages machine learning models that are continuously retrained, tailored to your data and behavior of your users, and can interpret data to detect anomalies and potentially fraudulent activities. It also provides tools to enhance credit decisioning and compliance management processes.

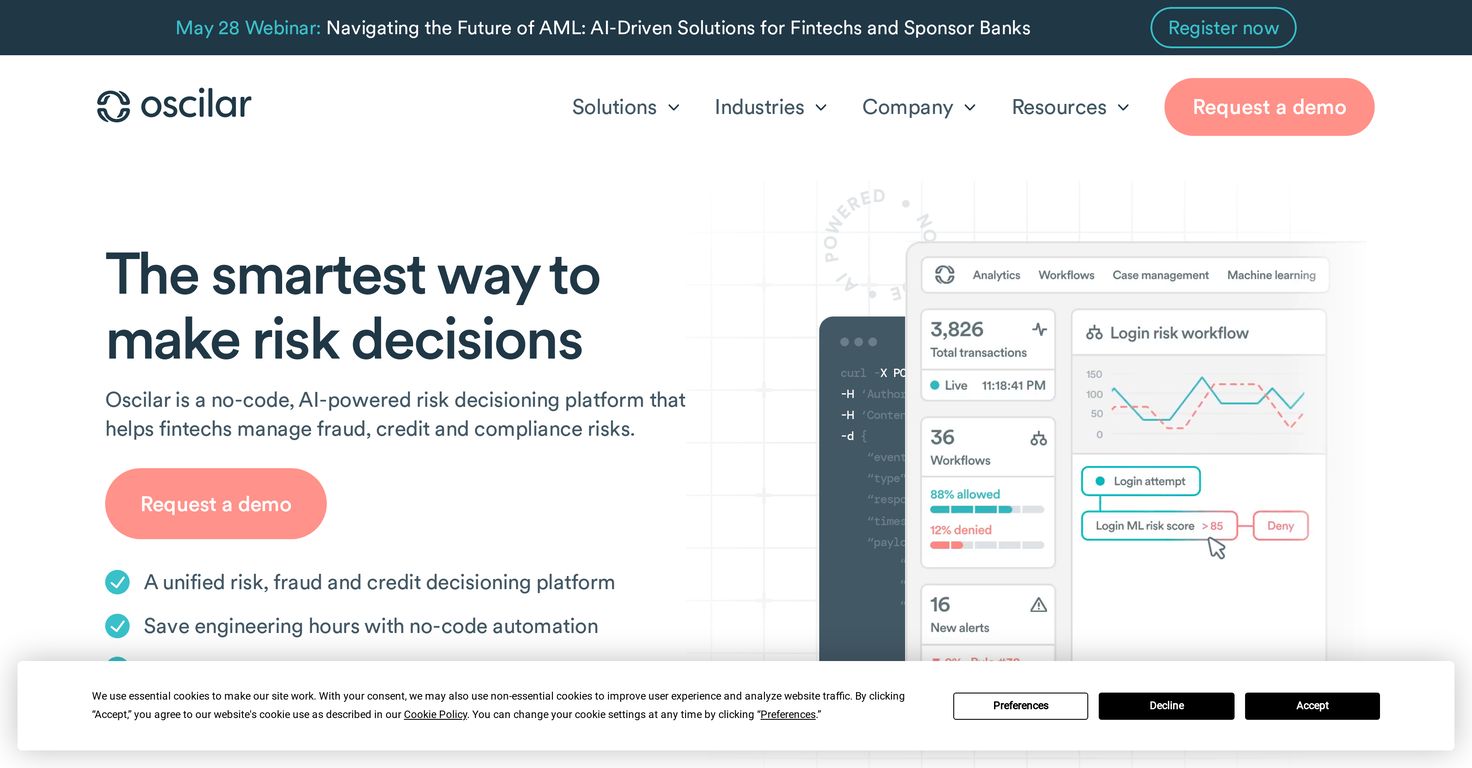

Does Oscilar require you to have a strong background in coding?

No, Oscilar does not require a strong background in coding. It is a no-code platform, designed to be user-friendly. This allows anyone in the risk team to create decisioning flows without requiring any help from an engineer or need for coding knowledge.

Can I use my own machine learning models on Oscilar?

Yes, Oscilar allows you to use your own machine learning models. While the platform itself features a robust machine learning component and offers hosted models, it also provides the flexibility to integrate and use your own machine learning models.

What is the purpose of Oscilar's data hub?

Oscilar's data hub serves as an integrated data platform that offers a comprehensive, real-time view of customers and transactions. It assimilates data from 1st party databases and 3rd party sources, allowing for velocity counters, lists, matrix models creation and more with a few clicks.

How does Oscilar offer a real-time view of customers and transactions?

Oscilar offers a real-time view of customers and transactions through its data hub which integrates data from various sources in real-time. This ensures that risk levels can be assessed with the most up-to-date understanding of customer behaviors and transactions.

What does Oscilar's case management system provide?

Oscilar's case management system is designed to reduce manual reviews, by delivering important transaction data automatically. This enables the finding and flagging of users exhibiting similar behavior which potentially represents risk, thus aiding in risk analysis and decision making.

Can Oscilar be used for fraud detection, credit risk, and compliance?

Yes, Oscilar can be used for fraud detection, credit risk and compliance. Its machine learning models and risk decisioning capabilities allow it to detect fraudulent activities, assess credit risks and manage compliance risks in real-time.

How can Oscilar rid me of the need for manual reviews?

Oscilar tackles the burden of manual reviews by implementing automated risk decision-making processes. Through case management system, it delivers important transaction data automatically, identifies and flags users showing similar behavior, and thereby reduces the need for extensive manual reviews.

What makes Oscilar efficient for risk assessment?

Oscilar is efficient for risk assessment for several reasons. It employs AI and machine learning to automate the risk decision-making process, leading to a significant reduction in manual effort. Additionally, it can adapt to unique data and user behaviors, integrate diverse data sources, provide real-time analysis, and facilitate efficient workflow creation and adaptation.

How does Oscilar help fintech companies save engineering hours?

Oscilar aids fintech companies in saving engineering hours through its no-code automation feature. This also enables risk analysts to change risk policies without relying on engineers. As a result, engineering resources can be freed up to concentrate on core business functions.

Can Oscilar integrate data from 1st party databases and 3rd party sources?

Yes, Oscilar can integrate data from 1st party databases and 3rd party sources. Users can bring together multiple data sources within Oscilar's data hub in just a few clicks, providing a 360-degree real-time view of customers and transactions.

Will Oscilar allow for gradual deployment of changed rules/workflows?

Yes, Oscilar permits gradual deployment of changed rules and workflows. Once these modifications are made, they can be tested using unit tests, backtests, shadow tests and A/B tests, before being gradually deployed from local to the staging environment and finally to the production environment.

Does Oscilar offer tools to reduce the risk of account takeovers?

Yes, Oscilar provides tools that aim to prevent account takeover incidents. Its suite of tools, encompassing decision-making workflows, machine learning models, and case-management systems, facilitates the detection and prevention of fraudulent activities, including account takeover attempts.

Can Oscilar help me in creating risk models and signals?

Yes, with Oscilar, you can create new risk models and signals without the need for coding. The platform allows you to define decisioning workflows using rules, ML models, velocity counters and more via an intuitive user interface. This helps in quickly identifying and reacting to any new risk signals.

Will Oscilar aid me in KYC fraud prevention?

Yes, Oscilar can assist in Know Your Customer (KYC) fraud prevention. Its comprehensive toolset provides capabilities like transaction monitoring, merchant onboarding, fraud detection, and prevention that play a critical role in ensuring KYC compliance and mitigating associated fraud risks.

MongoDB - Build AI That Scales

MongoDB - Build AI That Scales

How would you rate Oscilar?

Help other people by letting them know if this AI was useful.