-

Archmage🙏 13 karmaMay 14, 2024@WingmanI can't recommend wingman enough. I'm interested in AI so i've tried a bunch of them, like Rizz and Roast, but those seem like they barely use AI. Wingman has three tools, but I mostly use the dating Profile Roaster tool. It gives shockingly detailed and precise critiques of pics, and it ultimately resulted in me getting more Tinder matches. The dating-coach chatbot is also really good. Anyway, 5/5 stars. Check Wingman out.

Archmage🙏 13 karmaMay 14, 2024@WingmanI can't recommend wingman enough. I'm interested in AI so i've tried a bunch of them, like Rizz and Roast, but those seem like they barely use AI. Wingman has three tools, but I mostly use the dating Profile Roaster tool. It gives shockingly detailed and precise critiques of pics, and it ultimately resulted in me getting more Tinder matches. The dating-coach chatbot is also really good. Anyway, 5/5 stars. Check Wingman out. -

-

Among mobile apps this is the best tool making AI-written texts out of speech

Among mobile apps this is the best tool making AI-written texts out of speech -

-

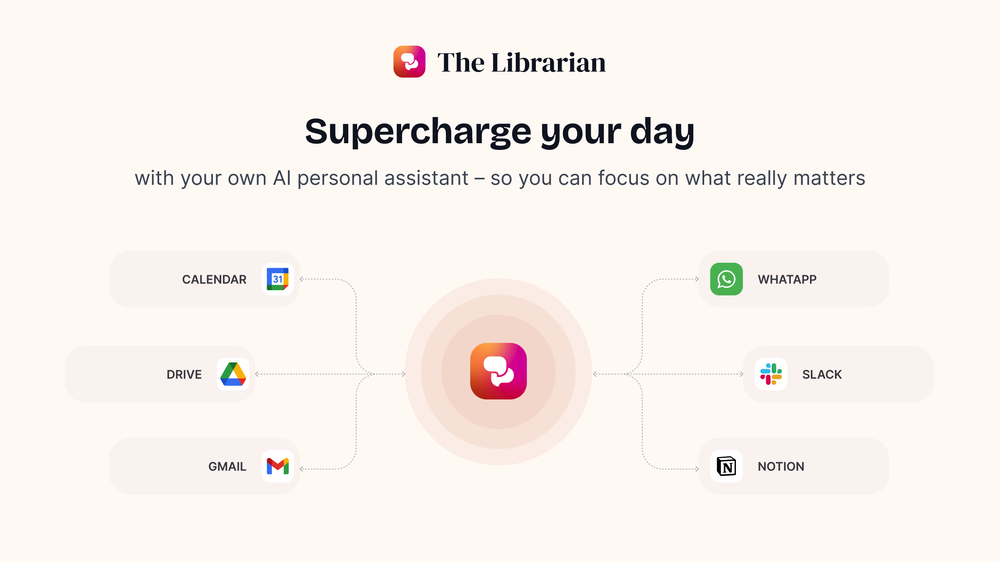

Hi Adil, thank you for reaching out. We are Google CASA certified and all the user data is encrypted in transit and at rest. Additionally, we do not store any user files on our side, ie, TheLibrarian.io knows where to find the information and point you on the right direction but all the files remain on your Google Drive, Notion, etc. Finally, user privacy is super important for us so even when you report a bug you do need to check the box that says "I allow The Librarian team to review this conversation." before anyone from the tech team can investigate the issue. If you have any further questions do not hesitate to reach us via email at [email protected].

Hi Adil, thank you for reaching out. We are Google CASA certified and all the user data is encrypted in transit and at rest. Additionally, we do not store any user files on our side, ie, TheLibrarian.io knows where to find the information and point you on the right direction but all the files remain on your Google Drive, Notion, etc. Finally, user privacy is super important for us so even when you report a bug you do need to check the box that says "I allow The Librarian team to review this conversation." before anyone from the tech team can investigate the issue. If you have any further questions do not hesitate to reach us via email at [email protected]. -

-

-

Congratulations on taking the initiative to manage your time effectively! Given your busy schedule, it's impressive that you're dedicated to your game project. Here's a suggested daily routine to help you optimize your time: **Morning Routine (5:00 am - 5:30 am)** * 5:00 am: Wake up, have a 10-minute meditation session to clear your mind * 5:10 am: Quickly check and respond to any urgent emails or messages related to your game project * 5:20 am: Plan out your day, prioritize tasks, and make a to-do list for your game project **Travel and College (5:30 am - 11:00 am)** * Travel to college, use this time to listen to podcasts, audiobooks, or educational content related to game development * Attend college from 8:00 am to 11:00 am **Lunch Break and Self-Care (11:00 am - 2:00 pm)** * Take a lunch break and use this time to relax, eat, and recharge * You can also utilize this time to read books, articles, or online resources related to game development * Take a short power nap (20-30 minutes) to refresh your mind **Work (2:00 pm - 5:00 pm)** * Focus on your work commitments during this time **Game Project Time (5:00 pm - 9:00 pm)** * 5:00 pm: Take a short break to grab a snack or stretch * 5:30 pm: Dedicate time to your game project, focusing on tasks such as: + Development and coding + Designing and prototyping + Testing and debugging + Research and learning new skills * 7:30 pm: Take a short break to relax and recharge * 8:00 pm: Continue working on your game project **Wind Down and Sleep (9:00 pm - 11:00 pm)** * 9:00 pm: Start wrapping up your game project tasks for the day * 9:30 pm: Take some time to relax, watch a movie, or read a book * 10:30 pm: Begin winding down, getting ready for bed * 11:00 pm: Sleep **Additional Tips** * Be flexible with your schedule, and adjust it as needed to accommodate any changes or unexpected tasks * Prioritize your tasks, focusing on the most important ones first * Take regular breaks to avoid burnout and maintain productivity * Learn to say "no" to non-essential commitments that may interfere with your game project or personal time * Review and adjust your schedule regularly to ensure it remains effective and realistic By following this routine, you can effectively utilize your time to work on your game project while maintaining your daily commitments. Remember to stay flexible and make adjustments as needed to ensure a healthy work-life balance. Good luck with your game project, and I hope this helps you overcome your daily routine challenges!

-

-

-

-

Amazing tool to get things done! Trully amazing use of AI

Amazing tool to get things done! Trully amazing use of AI -

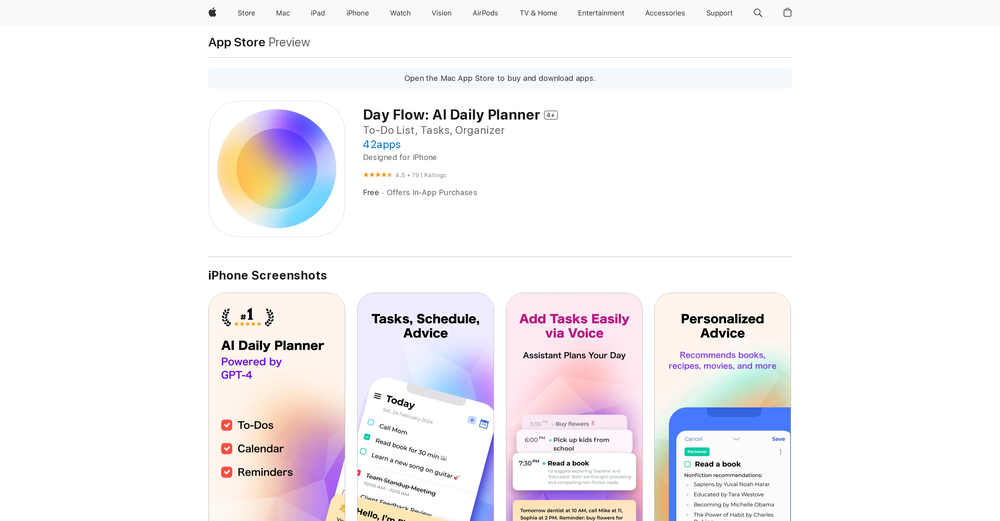

I've been exploring AI for quite some time, and it's been a true lifesaver for my severe ADHD. Finding the perfect calendar, task, and habit-tracking app that uses AI to intelligently schedule tasks with minimal interaction has been a quest. Day Flow is the closest I've found to my ideal solution. It's not perfect, but it's really good and incredibly helpful.

I've been exploring AI for quite some time, and it's been a true lifesaver for my severe ADHD. Finding the perfect calendar, task, and habit-tracking app that uses AI to intelligently schedule tasks with minimal interaction has been a quest. Day Flow is the closest I've found to my ideal solution. It's not perfect, but it's really good and incredibly helpful. -

-

Open

Open

-

Generates quirky, non-profane insults with a secretive, grumpy tone.Open

Generates quirky, non-profane insults with a secretive, grumpy tone.Open

-

-

-

Open

Open

-

-

-

-

AI-powered credit score advice in minutes.Open## Personalized Credit Score Improvement Plan ### Analyzing Your Current Credit Situation To provide you with a personalized action plan, I'll need some specific details regarding your credit situation, including: 1. **Outstanding debts**: Total amounts owed across different accounts (credit cards, loans, etc.). 2. **Payment history**: Any missed or late payments and their frequency. 3. **Credit utilization**: Current balances compared to credit limits on revolving accounts (like credit cards). 4. **Negative marks**: Any bankruptcies, foreclosures, or collections on your credit report. Once you provide this information, I can offer tailored strategies. For now, here’s a general plan that most users can follow based on common credit improvement areas: ### Comprehensive Plan for Improving Credit Score #### 1. **Check Your Credit Report** - **Action**: Obtain a free credit report from AnnualCreditReport.com. - **Reasoning**: Understanding your current credit standing is essential. This allows you to identify errors or negative marks that could be dragging your score down. - **Positive Impact**: Correcting inaccuracies can lead to a quick boost in your score. #### 2. **Reduce Credit Utilization** - **Action**: Aim to keep your credit utilization below 30%, ideally around 10%. - **Reasoning**: High credit utilization is considered risky by lenders and can lower your score. - **Positive Impact**: Lowering utilization shows you are using credit responsibly, thereby improving your score. #### 3. **Make Payments on Time** - **Action**: Set up reminders or automate payments for bills and loans. - **Reasoning**: Payment history is the most significant factor affecting your credit score. - **Positive Impact**: Consistently making on-time payments can significantly improve your score over time. #### 4. **Pay Down Debts** - **Action**: Focus on paying down high-interest debts first (the avalanche method) or smaller balances first (the snowball method). - **Reasoning**: Paying down debt reduces total obligation and impacts credit utilization positively. - **Positive Impact**: Decreasing debt levels improves your overall credit profile and reduces stress from debt loads. #### 5. **Avoid Opening New Credit Accounts** - **Action**: Resist the temptation to open new accounts unless necessary, and avoid too many inquiries. - **Reasoning**: Each new application can result in a hard inquiry, which can temporarily lower your score. - **Positive Impact**: Minimizing new credit applications helps maintain your average account age and reduces hard inquiries. #### 6. **Consider Becoming an Authorized User** - **Action**: If you have a trusted friend or family member with a good credit score and low utilization, ask to be added as an authorized user on their credit card. - **Reasoning**: This can improve your score by adding their positive payment history to your credit profile. - **Positive Impact**: Increased positive payment history and potentially lowering your utilization can provide a significant boost to your score. ### Maintaining a Healthy Credit Profile in the Long Term 1. **Monitor Your Credit Regularly**: Use free services or apps to track your credit score and report periodically. 2. **Build Good Financial Habits**: Create a budget to avoid overspending and to save for emergencies. 3. **Limit Hard Inquiries**: Only apply for credit when necessary, and consider soft inquiries when checking your own credit. 4. **Keep Old Accounts Open**: The length of your credit history influences your score, so keep older accounts active even if you don’t use them frequently. ### Recommendations for Next Steps - Gather your credit information (debts, payment history, etc.) and let me know the details so I can provide further tailored advice. - Start implementing the steps outlined, focusing on one or two at a time to avoid feeling overwhelmed. ### Conclusion Improving your credit score is a gradual process that requires diligence and attention to your financial behaviors. With consistent effort over the next 6 to 12 months, you should see significant improvements to your credit profile, leading to better financial opportunities in the future. Feel free to reach out with your specific credit details for a more tailored plan!

AI-powered credit score advice in minutes.Open## Personalized Credit Score Improvement Plan ### Analyzing Your Current Credit Situation To provide you with a personalized action plan, I'll need some specific details regarding your credit situation, including: 1. **Outstanding debts**: Total amounts owed across different accounts (credit cards, loans, etc.). 2. **Payment history**: Any missed or late payments and their frequency. 3. **Credit utilization**: Current balances compared to credit limits on revolving accounts (like credit cards). 4. **Negative marks**: Any bankruptcies, foreclosures, or collections on your credit report. Once you provide this information, I can offer tailored strategies. For now, here’s a general plan that most users can follow based on common credit improvement areas: ### Comprehensive Plan for Improving Credit Score #### 1. **Check Your Credit Report** - **Action**: Obtain a free credit report from AnnualCreditReport.com. - **Reasoning**: Understanding your current credit standing is essential. This allows you to identify errors or negative marks that could be dragging your score down. - **Positive Impact**: Correcting inaccuracies can lead to a quick boost in your score. #### 2. **Reduce Credit Utilization** - **Action**: Aim to keep your credit utilization below 30%, ideally around 10%. - **Reasoning**: High credit utilization is considered risky by lenders and can lower your score. - **Positive Impact**: Lowering utilization shows you are using credit responsibly, thereby improving your score. #### 3. **Make Payments on Time** - **Action**: Set up reminders or automate payments for bills and loans. - **Reasoning**: Payment history is the most significant factor affecting your credit score. - **Positive Impact**: Consistently making on-time payments can significantly improve your score over time. #### 4. **Pay Down Debts** - **Action**: Focus on paying down high-interest debts first (the avalanche method) or smaller balances first (the snowball method). - **Reasoning**: Paying down debt reduces total obligation and impacts credit utilization positively. - **Positive Impact**: Decreasing debt levels improves your overall credit profile and reduces stress from debt loads. #### 5. **Avoid Opening New Credit Accounts** - **Action**: Resist the temptation to open new accounts unless necessary, and avoid too many inquiries. - **Reasoning**: Each new application can result in a hard inquiry, which can temporarily lower your score. - **Positive Impact**: Minimizing new credit applications helps maintain your average account age and reduces hard inquiries. #### 6. **Consider Becoming an Authorized User** - **Action**: If you have a trusted friend or family member with a good credit score and low utilization, ask to be added as an authorized user on their credit card. - **Reasoning**: This can improve your score by adding their positive payment history to your credit profile. - **Positive Impact**: Increased positive payment history and potentially lowering your utilization can provide a significant boost to your score. ### Maintaining a Healthy Credit Profile in the Long Term 1. **Monitor Your Credit Regularly**: Use free services or apps to track your credit score and report periodically. 2. **Build Good Financial Habits**: Create a budget to avoid overspending and to save for emergencies. 3. **Limit Hard Inquiries**: Only apply for credit when necessary, and consider soft inquiries when checking your own credit. 4. **Keep Old Accounts Open**: The length of your credit history influences your score, so keep older accounts active even if you don’t use them frequently. ### Recommendations for Next Steps - Gather your credit information (debts, payment history, etc.) and let me know the details so I can provide further tailored advice. - Start implementing the steps outlined, focusing on one or two at a time to avoid feeling overwhelmed. ### Conclusion Improving your credit score is a gradual process that requires diligence and attention to your financial behaviors. With consistent effort over the next 6 to 12 months, you should see significant improvements to your credit profile, leading to better financial opportunities in the future. Feel free to reach out with your specific credit details for a more tailored plan! -

**Welcome to Your Personalized Credit Improvement Plan!** To create a tailored action plan for you, I'll need to know a bit more about your current credit situation. Please provide the following information: 1. **Current Credit Score Range:** (e.g., 600-649, 650-699, etc.) 2. **Total Debt Amount:** (including credit cards, loans, and other debts) 3. **Number of Credit Accounts:** (credit cards, loans, and other credit accounts) 4. **Existing Credit Accounts:** (list the type of account, e.g., credit card, student loan, mortgage, and the current balance) Once I have this information, I'll provide a detailed, step-by-step action plan to help you improve your credit score and manage your credit profile effectively. **Example Action Plan:** **Step 1: Reduce Debt (Weeks 1-4)** * Focus on paying off high-interest debt first (e.g., credit card debt) * Pay more than the minimum payment on the highest-interest debt * Consider debt consolidation or balance transfer options **Step 2: Improve Payment Timeliness (Weeks 5-8)** * Set up payment reminders or automate payments for all credit accounts * Make on-time payments for all accounts, including utility bills and rent * Consider enrolling in credit score tracking services to monitor progress **Step 3: Optimize Credit Utilization (Weeks 9-12)** * Aim to reduce credit utilization to below 30% for all credit accounts * Consider opening a new credit account to increase available credit * Make a plan to avoid new credit inquiries **Step 4: Build New Credit (After 12 Weeks)** * Apply for a secured credit card or become an authorized user on someone else's credit account * Make regular payments on the new account to demonstrate responsible credit behavior * Monitor credit report for errors and dispute any inaccuracies **Common Pitfalls to Avoid:** * Missing payments or making late payments * Applying for too many credit accounts in a short period * Closing old accounts, which can negatively affect credit utilization and credit age **Expected Credit Score Changes and Timeline:** * Within 3-6 months: Expect a 10-20 point increase in credit score * Within 6-12 months: Expect a 20-50 point increase in credit score * After 12 months: Continue to monitor credit score and adjust strategies as needed **Resources for Further Assistance:** * National Foundation for Credit Counseling (NFCC): 1-800-388-2227 * Credit Karma: Free credit monitoring and reporting * AnnualCreditReport.com: Free annual credit report from all three major credit bureaus Please provide the necessary information, and I'll create a personalized action plan tailored to your unique financial circumstances. Remember, improving credit takes time and effort, but with a clear plan and dedication, you can achieve your goals!

-

-

Open

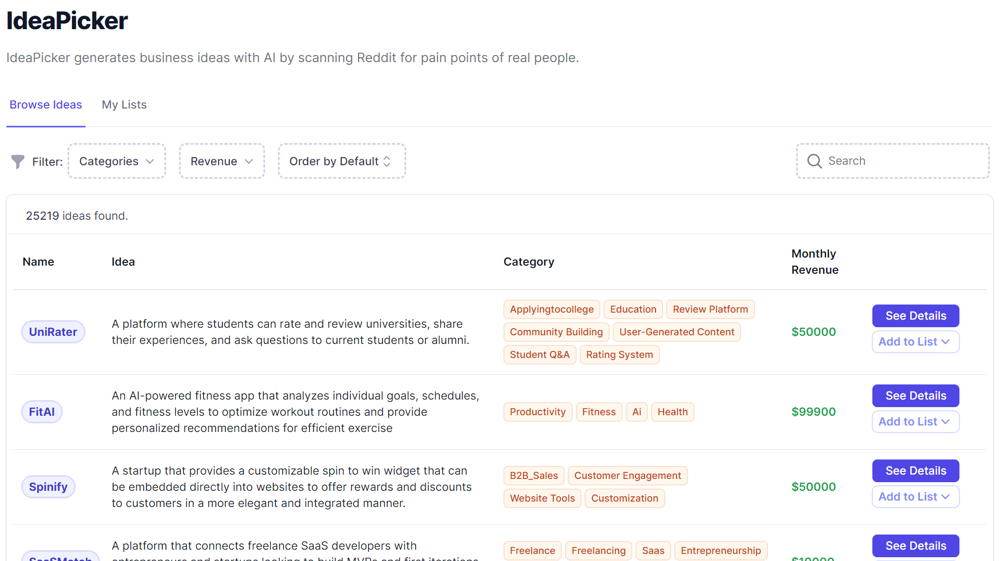

Yes that's a good idea, I'll create a field for initial investment. Thank you!

Yes that's a good idea, I'll create a field for initial investment. Thank you! -

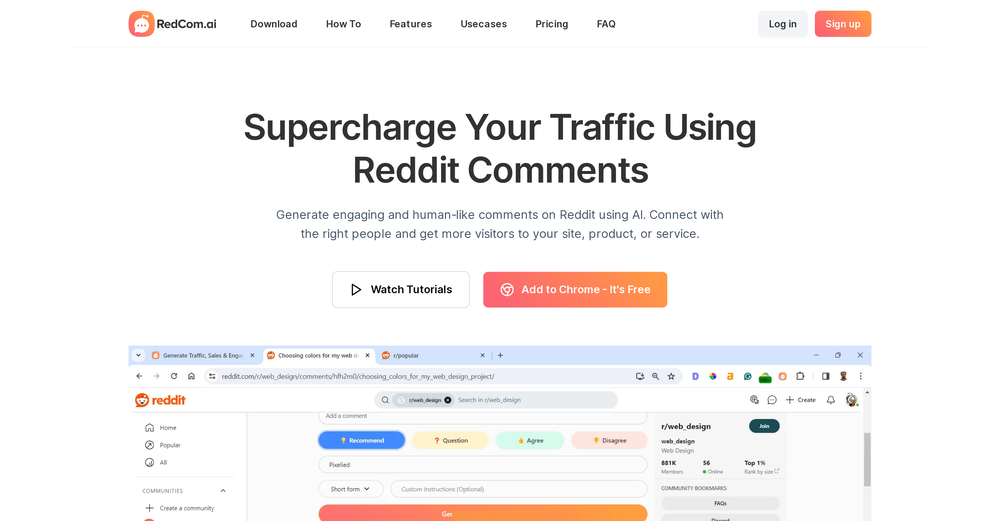

I am one of the earlier user. I generated tons of reports with insight for my product, and few leads and comments for engagement. In my opinion it's underpriced, but wishing all the best to the dev team.

I am one of the earlier user. I generated tons of reports with insight for my product, and few leads and comments for engagement. In my opinion it's underpriced, but wishing all the best to the dev team. -

Faster than sifting through reddit myself. TY for building.

Faster than sifting through reddit myself. TY for building. -

Thank you for your feedback Luca and for trying the app! Yeah currently there are other apps as well which can do more and better, but we have great plans to make ours even better than the other apps. We can’t do all at once but instead we will do it step by step which gonna take some time.

Thank you for your feedback Luca and for trying the app! Yeah currently there are other apps as well which can do more and better, but we have great plans to make ours even better than the other apps. We can’t do all at once but instead we will do it step by step which gonna take some time. -

-

-

-

-

Basically a random pickup generator, not worth your time.

Basically a random pickup generator, not worth your time. -

-

-

-

-

-

Cool yeah definitely let me know when you actually use the product

Cool yeah definitely let me know when you actually use the product -

Open

Open

-

-

Waste of disk space? We are on the cloud. Maybe you're reviewing the wrong service.

Waste of disk space? We are on the cloud. Maybe you're reviewing the wrong service. -

Open

Open

-

Glad that it helps! We are making it better. I would love your feedback!

Glad that it helps! We are making it better. I would love your feedback! -

Sponsor

Base44

💻 Vibe coding

#1 website for AI tools.Used by 80M+ humans.