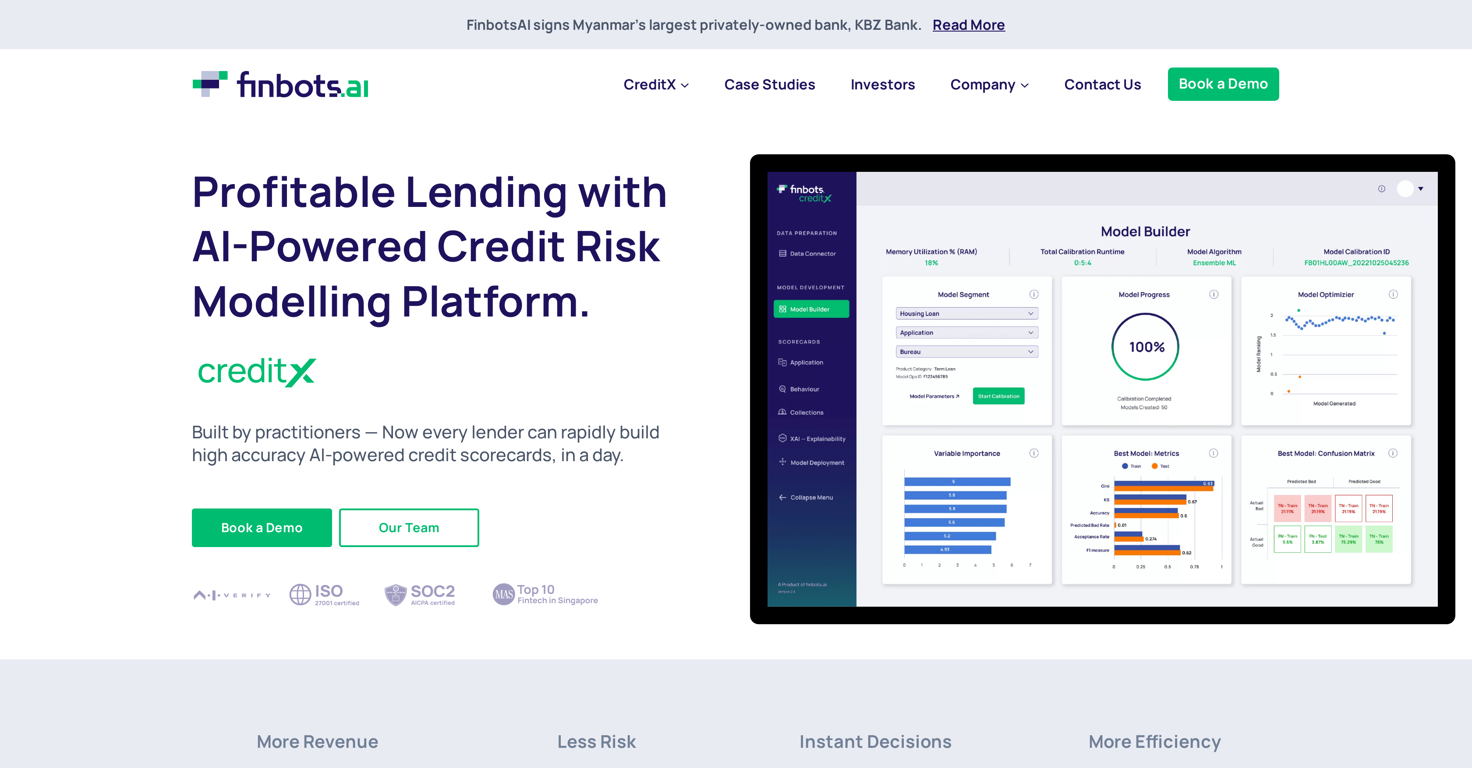

What is Finbots.ai?

Finbots.ai is an integrated, end-to-end, AI-powered credit modelling solution designed to enable smarter, faster, and more inclusive lending. The platform enables the quick construction of high-accuracy credit models, thereby reducing risk and saving cost,

What features does Finbots.ai offer for credit risk management?

Finbots.ai offers a number of features for credit risk management. These include the ability to construct high-accuracy credit models within minutes, an AI-led SaaS architecture that helps in the building, validation, and deployment of performance-oriented credit models across the full credit lifecycle and three scorecard types specifically designed for credit risk management, namely application scorecards, behaviour scorecards, and collection scorecards.

How does Finbots.ai's AI algorithms enhance credit models?

Finbots.ai's AI algorithms are designed to help in the construction, validation, and deployment of highly accurate credit models. These models enable more loan approvals with lower risk. The AI's superior predictive capabilities ensure better predictions of creditworthiness, thus providing for better and more inclusive lending practices.

How does Finbots.ai validate and deploy credit models?

Finbots.ai's platform uses an automatic process for the validation and deployment of credit models. Once built, the models are cross-validated using trained and tested frameworks to ensure accuracy. For deployment, the platform uses streamlined, single-click, API-based procedures.

What types of scorecards do Finbots.ai offer?

Finbots.ai offers three types of scorecards for managing credit risk, including application scorecards, behaviour scorecards, and collection scorecards. Each of these scorecards is designed to assist in minimizing risk and maximizing collections.

Can Finbots.ai operate with the systems I currently use?

Yes, Finbots.ai can function seamlessly with the data, workflows, and systems you currently have in place, operating on five core principles of accuracy, speed, transparency, adaptability, and inclusiveness.

What types of institutions normally use Finbots.ai?

Finbots.ai is typically trusted by a variety of financial institutions including banks, fintech lenders, SME lenders, BNPL players, and credit bureaus across the world.

How effective is Finbots.ai in increasing loan approvals?

Finbots.ai has shown significant effectiveness in increasing loan approvals, with an over 25% increase reported in approvals due to implementation of the tool.

What is the role of Finbots.ai in credit score prediction?

Finbots.ai plays a critical role in the prediction of credit score by using its proprietary AI algorithms to build high-accuracy credit models. These models allow more precise predictions of creditworthiness, facilitating better lending practices.

How does Finbots.ai utilize AI in building high-accuracy credit scorecards?

Finbots.ai uses proprietary AI to build high-accuracy credit scorecards. The platform connects to multiple data sources for data ingestion and automated validation, followed by data treatment processes. The scorecards are then built, validated, and deployed automatically, providing a comprehensive model for credit risk assessment and management.

How is the model builder feature of Finbots.ai CreditX utilized in credit risk assessment?

The model builder feature on Finbots.ai CreditX allows users to set parameters and modify Probability of Default (PD) levels to assess the impact on the model. By changing these parameters and seeing their effect, users can fine-tune their models for optimal outcomes.

How is data ingested and validated on Finbots.ai CreditX?

Finbots.ai CreditX uses a connection to multiple data sources for data ingestion. The platform includes automated validation features that facilitate data treatment processes, including transformation, standardization & hot encoding, and bias reduction the models are then built, validated, and deployed automatically.

Does Finbots.ai CreditX use only internal data for credit risk predictions?

No, Finbots.ai CreditX does not use only internal data. It connects internal, external, and alternate data for a detailed and comprehensive analysis. This enables users to base their credit risk predictions on a vast amount of diverse data, enhancing the accuracy of the predictions.

Can you modify PD levels with Finbots.ai CreditX?

Yes, with Finbots.ai CreditX, users can modify PD levels. The model builder feature allows users to set their model parameters and change PD levels to assess the impact on the model. By altering these parameters, users can optimize their models to best suit their specific needs and goals.

What is the developers' background who made Finbots.ai?

Finbots.ai was founded in Singapore by a team of former C-Suites, data scientists, and technologists. The team combines global domain knowledge in finance with deep technological expertise to deliver accessible and cutting-edge fintech solutions.

What is the AI governance testing framework 'AI Verify' that Finbots.ai has completed?

'AI Verify' is an AI Governance Testing Framework launched by the Singapore Government. Finbots.ai was one of the first AI solutions to complete this framework, which is aimed at building trustworthy and transparent AI technology.

How much can Finbots.ai CreditX reduce operating costs?

Finbots.ai CreditX can drastically reduce operating costs, with some institutions seeing a reduction of over 50%.

Does Finbots.ai have partnerships in the industry?

Yes, Finbots.ai has partnerships in the industry and its clients include reputable financial institutions worldwide, demonstrating its usefulness and industry acceptance.

Where can I find case studies of Finbots.ai implementations?

Case studies of Finbots.ai implementations can be found directly on their website under the 'Case Studies' section. Here you can find examples of how the tool has been used successfully in various institutions from different sectors.

How does Finbots.ai facilitate faster deployment for financial institutions?

Finbots.ai CreditX facilitates faster deployment for financial institutions by using its proprietary AI to build high-accuracy credit scorecards quickly. It streamlines model deployment and monitoring with single-click, API-based procedures, allowing for rapid turnaround times.