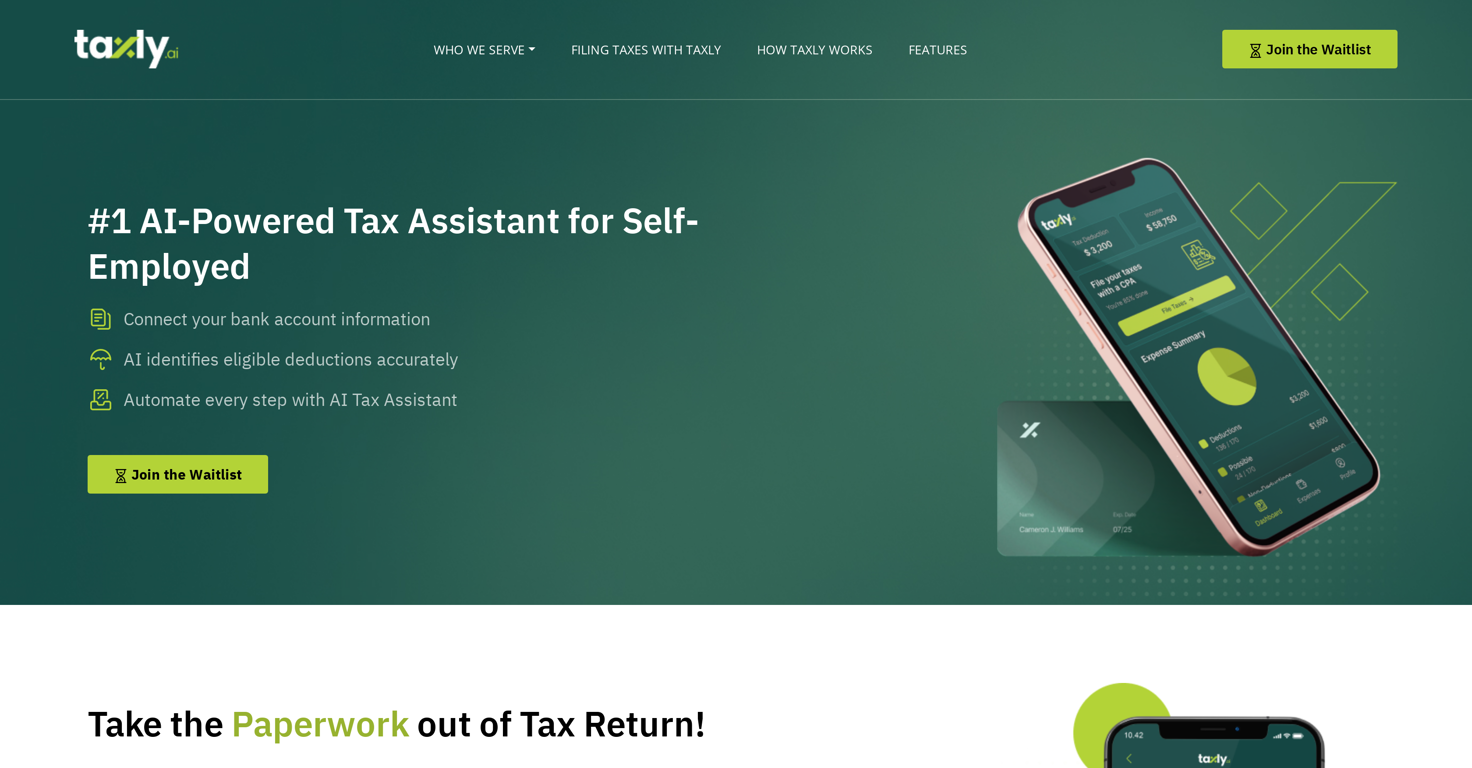

What is Taxly.ai?

Taxly.ai is an advanced, AI-powered tax application that streamlines tax filing and reconciliation processes. It identifies potential tax deductions, provides automated estimates, delivers real-time expense tracking, and conducts automated calculations for efficient tax filing. Designed for Australian users, it adheres to ATO Tax guidelines and ensures data security with robust encryption and strict privacy measures.

Who can use Taxly.ai?

Taxly.ai serves individuals, freelancers, self-employed professionals, and sole traders, including those with multiple income streams and side gigs. Hence, it's ideal for anyone who wants to simplify and automate their tax filing process.

How does Taxly.ai use AI technology to simplify tax filing?

Taxly.ai uses AI technology to automate every step of the tax filing process. AI scans transactions to find eligible tax savings, categorizes them automatically, and calculates potential deductions based on user's transactions and expenses. It even provides personalized tax recommendations, insights, and planning advice via advanced AI algorithms.

What strategies does Taxly.ai employ to minimize tax liabilities?

Taxly.ai employs strategic solutions to minimize tax liabilities. It provides accurate AI tax return ATO filtering and analysis, AI-empowered quarterly tax calculations, and CPA-assisted tax review and management to ensure compliance and maximize savings.

How does Taxly.ai help to optimize tax deductions?

Taxly.ai optimizes tax deductions using AI technology that smartly scans transactions to identify potential savings and categorize them automatically. It maximizes user's deductions by tracking expenses in real-time and automating calculations.

How does Taxly.ai help small business owners manage their taxes?

Taxly.ai offers sole traders and small business owners a seamless way to manage their finances and comply with tax laws. They can connect their bank accounts and transactions to automatically identify eligible deductions, track real-time expense, and estimate quarterly taxes. All records are stored in one place for easy access and management.

What support services does Taxly.ai offer?

Taxly.ai offers CPA support to all users. They can get human assistance from a certified CPA team, who can review tax information as needed. Additionally, there are expert consultations available for personalized tax advice and compliance. Users also have the facility to inquire about deductions or any aspect of the tax filing process.

Does Taxly.ai integrate with other financial tools or accounting software?

Yes, Taxly.ai allows users to integrate with any accounting software to manage finances effectively. This feature makes financial management convenient, seamless, and efficient.

How can users ensure the accuracy and compliance of their taxes with Taxly.ai?

Users can ensure the accuracy and compliance of their taxes with Taxly.ai through data-driven automated calculations, AI tax return ATO filtering and analyses, CPA review, and personalized expert consultations. Its features comply with Australian tax guidelines, ensuring compliance and accuracy in tax reports.

What is the CPA support in Taxly.ai?

The CPA support in Taxly.ai includes a team of certified tax professionals providing review and human assistance to the users. They provide expert support every step of the way for efficient tax management, offering their expertise to simplify tax time in Australia.

How is user data secured on Taxly.ai?

Taxly.ai ensures data security with robust encryption and strict privacy measures. The platform's security protocols are designed to protect user's financial and personal information at all times.

What makes Taxly.ai an efficient tool for tax filing?

Taxly.ai is an efficient tool for tax filing because it automates the entire process, seamlessly tracking and categorizing deductions, connecting bank accounts for easy transaction scanning, and auto-calculating deductions. It also provides advance AI-powered ATO Tax recommendations, offers expert consultations, and supports users even with multiple income streams.

How does Taxly.ai help in tracking and categorizing tax deductions?

Taxly.ai uses AI to help users track and categorize tax deductions. It automatically scans transactions for eligible deductions, categorizes them, and delivers real-time expense tracking. Users can approve or reject deductions, ensuring only valid expenses are recorded and tracked.

Can Taxly.ai aid in tax planning?

Yes, Taxly.ai also aids in tax planning by offering insights for optimizing savings. It helps in planning and preparing for the upcoming financial year. It accomplishes this by utilizing advanced AI algorithms to offer personalized tax savings recommendations based on detailed analysis of users' income and expenditure.

How does Taxly.ai offer personalized tax recommendations?

Taxly.ai generates personalized tax recommendations using AI algorithms. These recommendations are based on an AI-driven analysis of users' transactions, deductions, and overall financial behavior. The outcome is personalized to each user, providing advice tailored to their unique financial and tax situation.

Does Taxly.ai help with quarterly taxes?

Yes, Taxly.ai helps with quarterly taxes. It houses advanced AI-based quarterly tax calculators that estimate quarterly tax payments based on users' transactions and deductions. This feature ensures that users can make timely, penalty-free payments.

Can Taxly.ai connect to a user's bank account?

Yes, Taxly.ai can connect to a user's bank account. This connection allows the AI to scan transactions, identify eligible tax savings, and categorize deductions automatically.

How are eligible tax savings identified by Taxly.ai?

Eligible tax savings are identified by Taxly.ai using AI technology. The AI scans user's transactions and identifies potential tax deductions based on algorithmic analysis of these transactions.

Can Taxly.ai scan transactions for possible deductions?

Yes, Taxly.ai can scan transactions for possible deductions. Its AI technology scans every transaction to find eligible tax savings and categorize them automatically, thus maximizing the deductions efficiency by 98%.

How does Taxly.ai aid to those with multiple income streams?

For individuals with multiple income streams, Taxly.ai provides support by automating the tax filing process. It identifies and tracks deductions across all income sources, offers automated calculations, and provides real-time expense tracking. This makes tax filing streamlined and efficient for freelancers and those in the gig economy.