Tendi

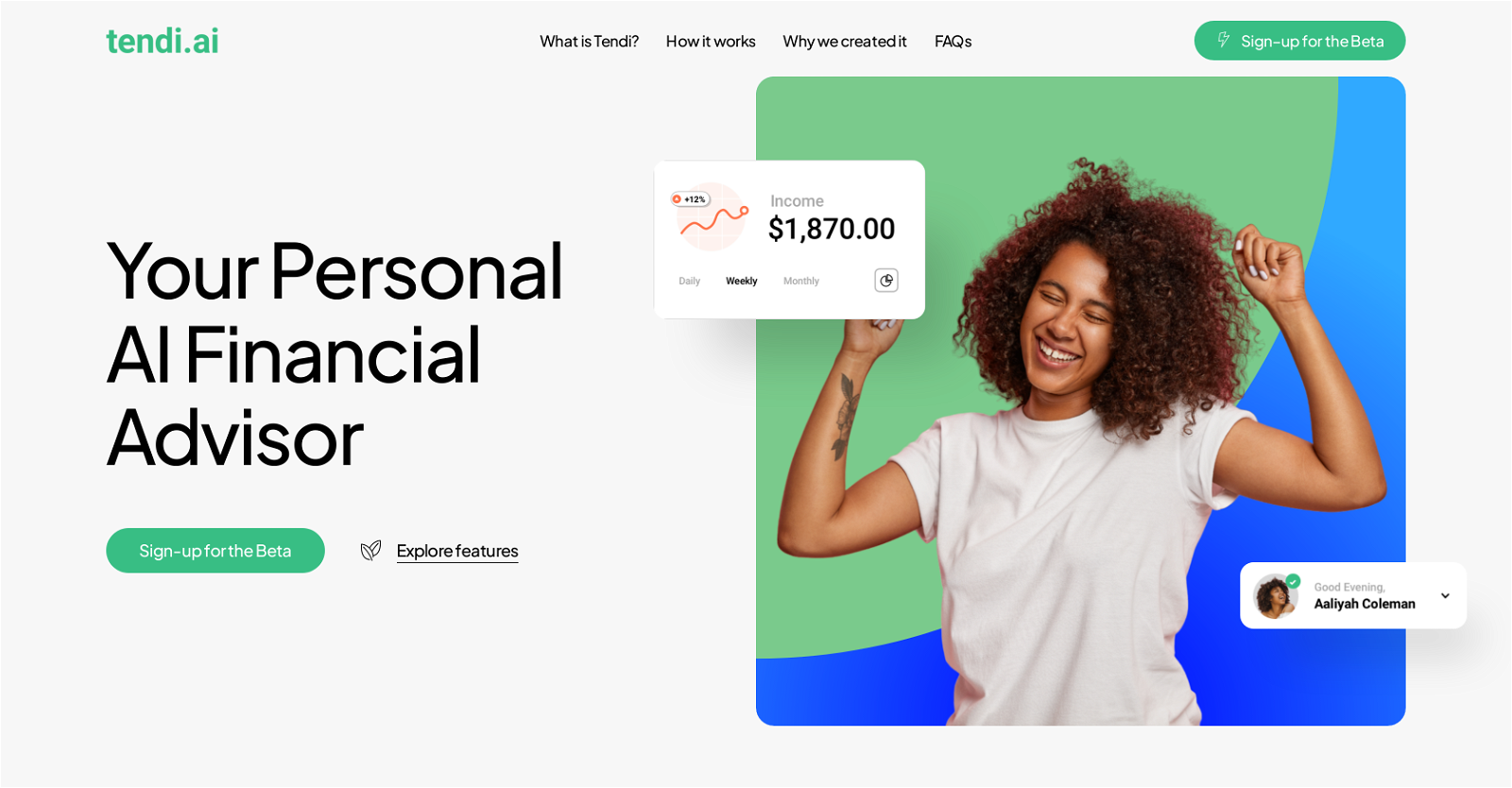

Tendi is an AI-powered tool designed to serve as a personal financial advisor. It is tailored to guide users on matters of budgeting, debt reduction, savings growth, investment, and retirement planning.

The platform makes it possible to have a personal advisor that comprehends the users financial standing and formulates tailored monetary strategies. It achieves this by analyzing the users spending patterns and saving behavior, converting these data into actionable insights.

Tendi provides features that link to users financial accounts securely, tracks their progress towards set goals, and alerts them to significant financial changes.

Moreover, it has chat functions for personalized financial advice and a simple dashboard display that summarizes financial health in a user-friendly manner.

It was explicitly devised to bridge gaps in financial education and wealth disparity by making sophisticated, customized financial guidance accessible to every individual.

Tendi was created by a seasoned team composed of AI and finance professionals with backgrounds from companies like Netflix, Roku, Paramount+, and more.

It stands out for its enhanced data protection measures which include advanced encryption, industry-standard cybersecurity practices, and steadfast privacy protocols.

Tendi can assist with various financial goals, making it an ideal tool for both beginners and more advanced users. It offers a free basic version alongside a competitively-priced premium subscription for more advanced features.

Would you recommend Tendi?

Help other people by letting them know if this AI was useful.

Feature requests

94 alternatives to Tendi for Financial advice

-

151

-

5.0

851

851 -

70

-

33

-

17

-

13

-

5.06

-

6182

6182 -

694

694 -

5

-

4

-

4

-

4605

4605 -

431

431 -

41

-

332

332 -

333

333 -

310

310 -

35

35 -

3103

3103 -

257

257 -

219

219 -

288

288 -

2

-

22

22 -

Answering finance questions with a Warren Buffett twist.2

Answering finance questions with a Warren Buffett twist.2 -

283

283 -

Providing the best tax and accounting services for businesses, investors, and entrepreneurs.2

Providing the best tax and accounting services for businesses, investors, and entrepreneurs.2 -

A knowledgeable guide for financial education and investment strategies.277

A knowledgeable guide for financial education and investment strategies.277 -

Helping you keep track of your Financial Independence, Retire Early (FIRE) goals.2

-

215

215 -

5.021

-

214

214 -

27

27 -

2329

2329 -

An AI that advises on purchases based on cash availability.2

An AI that advises on purchases based on cash availability.2 -

Your guide to wealth creation, covering investments, savings, and more.22

Your guide to wealth creation, covering investments, savings, and more.22 -

283

283 -

211

211 -

233

233 -

24

24 -

Professional, friendly finance advisor in multiple languages.2

Professional, friendly finance advisor in multiple languages.2 -

2

2 -

120

120 -

111

111 -

130

130 -

19

19 -

19

19 -

11

11 -

132

132 -

110

110 -

146

146 -

16

16 -

1

-

1

1 -

120

120 -

1100

1100 -

17

17 -

110

110 -

Expert in personal finance, guiding on saving, budgeting, and investing.17

Expert in personal finance, guiding on saving, budgeting, and investing.17 -

A versatile finance assistant, adept in both professional and friendly advice.123

A versatile finance assistant, adept in both professional and friendly advice.123 -

171

171 -

I help you lower your bills and save money1117

I help you lower your bills and save money1117 -

111

111 -

148

148 -

9

9 -

-

Personal finance expert on IRAs, 401Ks, investments, and more.8

Personal finance expert on IRAs, 401Ks, investments, and more.8 -

5

5 -

10

10 -

30

30 -

10

10 -

Providing top-notch CPA Bookkeeping services for your business.

Providing top-notch CPA Bookkeeping services for your business. -

2

2 -

-

43

43 -

45

45 -

-

-

10

10 -

Voice of the CFO for financial analysis and strategic budgeting advice.2

-

Advanced AI for global financial insights and personalized advice.13

Advanced AI for global financial insights and personalized advice.13 -

25

25 -

4

4 -

Leading the way in Investment Advice, Market Analysis, and Custom Financial Strategies in Spanish.32

Leading the way in Investment Advice, Market Analysis, and Custom Financial Strategies in Spanish.32 -

Your friendly expert in finance, making complex topics accessible and engaging.25

Your friendly expert in finance, making complex topics accessible and engaging.25 -

14

14 -

51

51 -

22

22 -

117

117 -

95

95 -

16

16 -

89

89 -

45

45

Pros and Cons

Pros

Cons

Q&A

If you liked Tendi

Featured matches

Other matches

People also searched

Help

To prevent spam, some actions require being signed in. It's free and takes a few seconds.

Sign in with Google