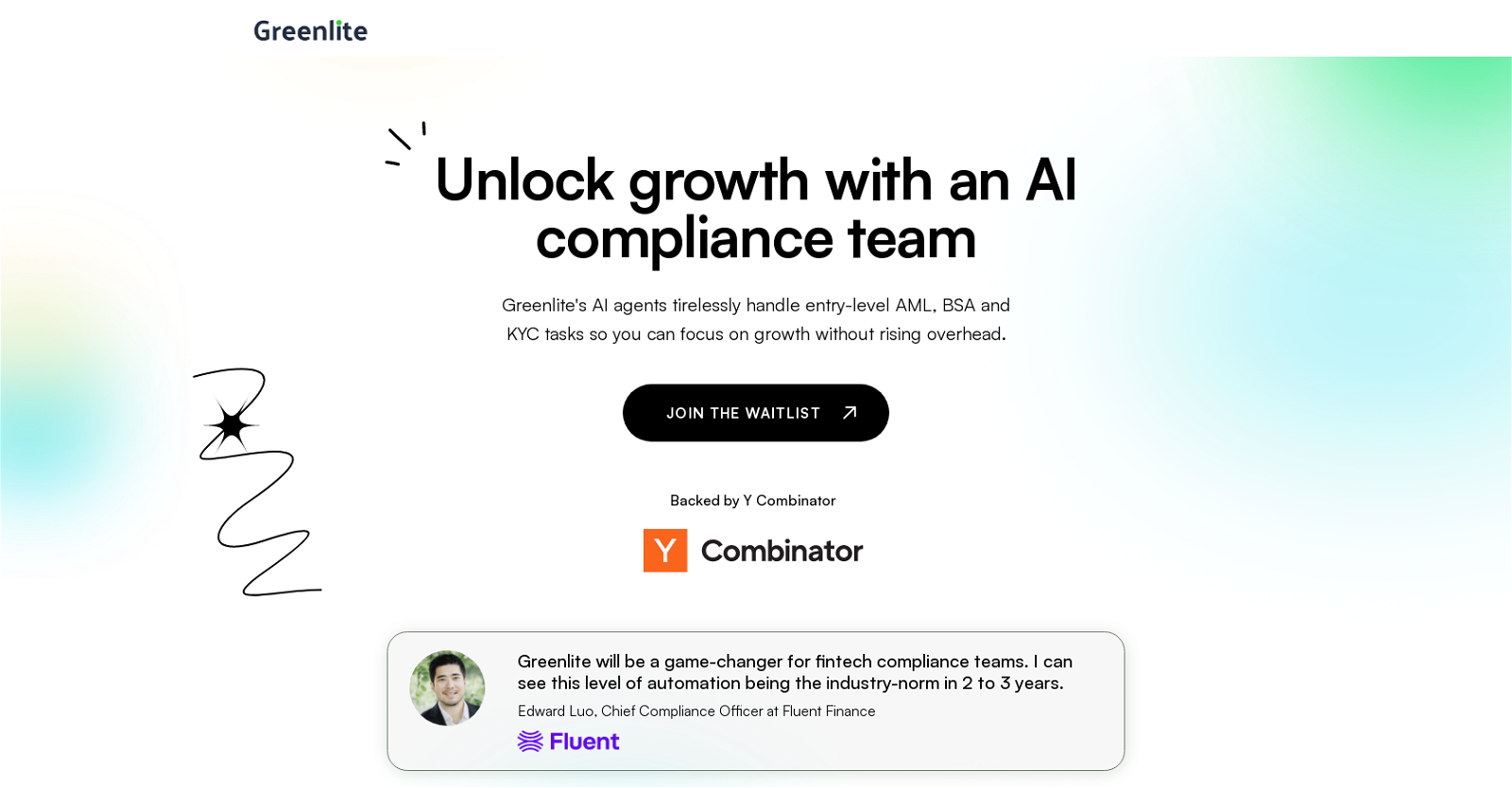

What is Greenlite?

Greenlite is an AI automation platform specifically designed to support compliance teams in the fintech industry. It seeks to streamline the fulfillment of entry-level compliance roles through AI automation, thus increasing efficiency and productivity.

What does Greenlite offer that differentiates from other AI automation tools?

Greenlite provides the unique advantage of fulfilling, through AI, entire entry level compliance roles that are usually performed by humans. It employs AI agents which work tirelessly and efficiently, processing larger volumes of transactions, thus giving small teams the ability to compete with larger ones.

How does Greenlite aim to enhance the efficiency and productivity of fintech compliance teams?

Greenlite enhances the efficiency and productivity of fintech compliance teams by automating various tasks such as onboarding, risk assessments, sanctions, and AML. The AI agents in the platform assist in the seamless processing of data, which saves time and leads to faster decision-making efforts.

What functions primarily does Greenlite focus on?

Greenlite primarily focuses on tasks such as anti-money laundering (AML), sanctions screening, and Know Your Customer (KYC) obligations. The AI agents are capable of automatically reviewing onboarding cases, responding to alerts, and conducting risk assessments, thus covering various areas of compliance.

How does Greenlite's AI agent work?

Greenlite's AI agents execute tasks through a process beginning with area selection for staff augmentation, after which the selected tasks are automatically reviewed and completed by the AI. The users can then integrate their preferred data sources and finally review the reports generated by the AI for decision making.

What are the key tasks Greenlite's AI agent can perform?

Greenlite's AI agents can perform a host of tasks such as automatically reviewing onboarding cases, responding to incoming alerts, and conducting risk assessments for customers, counterparties, and transactions. They also have the capacity to compile 360-degree views of high-risk customers or counterparties aiding in efficient ongoing monitoring.

Can Greenlite integrate data from my preferred sources?

Yes, Greenlite's platform allows users to choose their preferred data sources. This ensures data source integration and retrieval of relevant information from a wide range of available resources.

What are the benefits experienced by users of the Greenlite platform?

Users of Greenlite platform can experience a wide range of benefits including faster customer onboarding, substantial cost savings per analyst, and reduced case-closure times. By automating routine compliance tasks, organizations can cut overheads and redeploy human resources to more strategic tasks.

How does Greenlite help in the automation of entry-level compliance functions?

Greenlite assists with the automation of entry-level compliance functions by employing AI agents. These agents automate tasks like case reviews, alert responses, and risk assessments which are key compliance functions. This reduces the workload on compliance teams and contributes to faster processing and decision-making.

What does the process look like when using Greenlite?

When using Greenlite, the process begins with selecting a specific practice area where staff augmentation is needed. AI agents then take over, automatically reviewing onboarding cases, ingesting alerts, and conducting risk assessments. The user chooses their preferred data sources, from which the system gathers useful data. Finally, users can review the reports and make informed decisions.

What makes Greenlite a transformative tool for fintech compliance teams?

Greenlite is a transformative tool for fintech compliance teams because it automates time-consuming tasks and optimizes resources. By adopting AI automation, teams can process larger transaction volumes with increased efficiency and make highly informed decisions, thus transforming their productivity levels.

How does Greenlite assist with automated fintech compliance process optimization?

Greenlite assists with automated fintech compliance process optimization by automating the fulfillment of entry-level compliance roles. This enables compliance teams to process more transactions faster and with more accuracy, leading to improved operational efficiency.

How can Greenlite help to reduce costs for fintech compliance teams?

Greenlite can help reduce costs for compliance teams by automating routine and time-consuming tasks. This results in substantial savings per analyst which translates into reduced overheads for the compliance team.

How can Greenlite help to increase productivity for fintech compliance teams?

Greenlite increases productivity by automating routine tasks, allowing the compliance team to focus on strategic and higher-value tasks. The automation platform enables faster processing and decision-making, hence enhancing productivity.

What is the return on investment when using Greenlite?

Return on investment when using Greenlite is significant due to faster customer onboarding, substantial cuts in analyst-related expenses, and the ability to close cases in half the time – all contributing to enhanced operational efficiency and reduced costs.

How does Greenlite assist with customer onboarding?

Greenlite assists with customer onboarding by automatically reviewing and processing onboarding cases. By employing AI agents to conduct these tasks, customer onboarding can be done more quickly and efficiently.

Is Greenlite user-friendly for non-technical compliance members?

Though the specifics have not been stated, Greenlite is designed to be utilized by compliance teams in the fintech industry, suggesting a user-friendly design to accommodate both technical and non-technical members.

What industries can best benefit from using Greenlite?

The fintech industry, particularly compliance teams within this industry, stand to benefit most from using Greenlite. Its automation capabilities apply specifically to tasks like AML measures, sanctions screening, and KYC processes encountered in this space.

How does Greenlite help in mitigating risks for fintech compliance?

Greenlite aids in mitigating risks for fintech compliance by automating tasks such as risk assessments for customers, counterparties, and transactions. This ensures data is analyzed and processed accurately, minimizing the chances of oversight and ensuing risks.

How can I join the waitlist for Greenlite?

You can join the waitlist for Greenlite by providing your name and work email on Greenlite's home page.

755

755 Your personal AI agent, planning and executing tasks semi-autonomously.92K

Your personal AI agent, planning and executing tasks semi-autonomously.92K Maximize efficiency with Mojju's AI Personal Assistant.9200

Maximize efficiency with Mojju's AI Personal Assistant.9200 Advanced organizer with self-learning AI.4

Advanced organizer with self-learning AI.4 324

324 2379

2379 Make phone calls to real people and businesses with voice AI.233

Make phone calls to real people and businesses with voice AI.233 3

3